The Role of Bid Bonds in Mitigating Financial Dangers in Contracting

The Role of Bid Bonds in Mitigating Financial Dangers in Contracting

Blog Article

Vital Steps to Make Use Of and obtain Bid Bonds Properly

Browsing the complexities of bid bonds can considerably affect your success in protecting contracts. The genuine difficulty exists in the meticulous selection of a credible service provider and the tactical utilization of the proposal bond to improve your affordable edge.

Understanding Bid Bonds

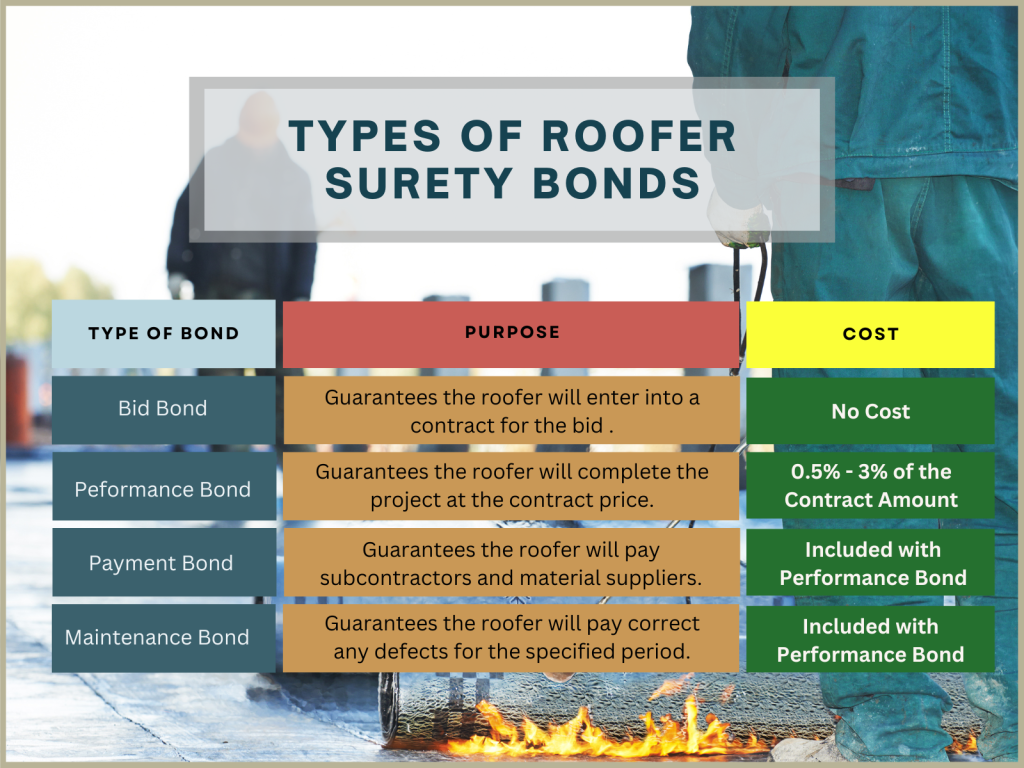

Quote bonds are a vital part in the building and having sector, serving as a financial assurance that a bidder intends to get in right into the contract at the proposal price if awarded. Bid Bonds. These bonds alleviate the danger for project owners, ensuring that the chosen service provider will certainly not only recognize the proposal yet also safe performance and payment bonds as called for

Basically, a quote bond functions as a protect, protecting the project proprietor against the economic effects of a contractor stopping working or taking out a proposal to commence the job after choice. Typically released by a surety firm, the bond warranties compensation to the owner, commonly 5-20% of the proposal quantity, ought to the contractor default.

In this context, bid bonds foster a much more credible and affordable bidding environment. Bid bonds play an essential function in preserving the stability and smooth procedure of the construction bidding process.

Planning For the Application

When preparing for the application of a proposal bond, careful company and comprehensive documents are critical,. A comprehensive review of the task specs and quote needs is vital to ensure conformity with all specifications. Begin by constructing all needed economic statements, including equilibrium sheets, income declarations, and capital declarations, to demonstrate your firm's financial health. These papers ought to be existing and prepared by a licensed accountant to improve integrity.

Next, assemble a listing of previous jobs, specifically those comparable in scope and size, highlighting successful conclusions and any distinctions or accreditations received. This profile acts as proof of your company's capacity and reliability. Furthermore, prepare a detailed business strategy that outlines your operational approach, danger management techniques, and any type of backup plans in location. This strategy provides an alternative view of your company's technique to job implementation.

Make certain that your company licenses and registrations are current and conveniently available. Having actually these files organized not just accelerates the application process but likewise projects an expert picture, instilling self-confidence in possible surety carriers and job proprietors - Bid Bonds. By carefully preparing these aspects, you place your company favorably for successful bid bond applications

Discovering a Surety Service Provider

Additionally, think about the company's experience in your details industry. A guaranty business knowledgeable about your field will better recognize the one-of-a-kind risks and requirements related to your jobs. Request references and inspect their history of cases and customer fulfillment. It is also advisable to assess their financial ratings from agencies like A.M. Finest or Standard & Poor's, ensuring they have the monetary toughness to back their bonds.

Engage official website with several companies to contrast terms, rates, and services. A competitive analysis will certainly assist you secure the most effective terms for your bid bond. Ultimately, a complete vetting procedure will make sure a trusted partnership, promoting self-confidence in your quotes and future projects.

Sending the Application

Submitting the application for a proposal bond is a critical step that requires meticulous focus to information. This process begins by collecting all pertinent documentation, including economic declarations, project requirements, and a thorough organization background. Making sure the accuracy and completeness of these records is extremely important, as any kind of disparities can cause denials or hold-ups.

When filling out the application, it is recommended to verify all entrances for precision. This consists of confirming numbers, making certain appropriate signatures, and validating that all necessary accessories are consisted of. Any kind of mistakes or omissions can undermine your application, triggering unnecessary difficulties.

Leveraging Your Bid Bond

Leveraging your quote bond properly can significantly improve your affordable side in safeguarding agreements. A proposal bond not only demonstrates your monetary stability however also guarantees the task owner of your dedication to meeting the contract terms. By showcasing your proposal bond, you can underline your firm's reliability and credibility, making your bid stand apart amongst countless rivals.

To leverage your quote Visit Your URL bond to its max potential, guarantee it is offered as part of an extensive quote package. Highlight the toughness of your guaranty copyright, as this reflects your company's monetary wellness and functional capability. Furthermore, stressing your performance history of effectively completed jobs can even more infuse self-confidence in the task owner.

In addition, maintaining close interaction with your guaranty copyright can assist in much better conditions in future bonds, therefore reinforcing your affordable placing. An aggressive strategy to managing and restoring your proposal bonds can additionally stop gaps and guarantee continuous insurance coverage, which is important for ongoing project purchase efforts.

Verdict

Properly using and getting quote bonds requires complete preparation and strategic implementation. By comprehensively organizing essential documents, choosing a reputable guaranty provider, and submitting a complete application, companies can safeguard the necessary bid bonds to enhance their competition.

Determining a credible guaranty provider is a crucial action in safeguarding a quote bond. A quote bond not only demonstrates your economic security yet additionally assures the job owner of your commitment to fulfilling the contract terms. Bid Bonds. By showcasing your bid bond, you can underline your firm's integrity and reputation, making your quote stand out amongst numerous rivals

To leverage your proposal bond to its max possibility, ensure it is provided as part of a comprehensive quote package. By adequately arranging key documents, selecting a reliable guaranty copyright, and sending a complete application, companies can protect the essential bid bonds to improve their competition.

Report this page